oklahoma franchise tax instructions

To make this election file Form 200-F. Corporations that remitted the maximum.

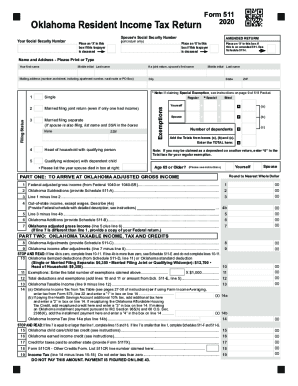

511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions Fill Out And Sign Printable Pdf Template Signnow

Oklahoma franchise tax is due and payable each year on July 1.

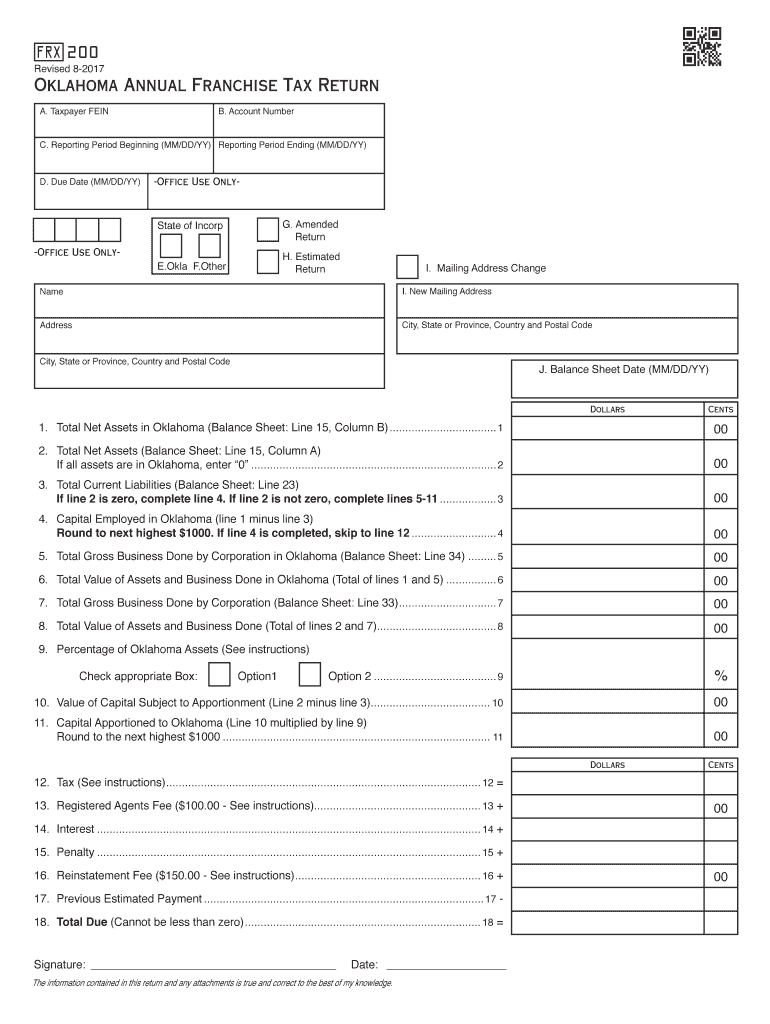

. On the Oklahoma Tax Commission website go to the Business Forms page. Scroll down the page until you find Oklahoma Annual Franchise Tax. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512.

Payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Mine the amount of franchise tax due. Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an.

For a corporation that has elected to change its filing period to match its fiscal year the franchise. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma. To file your Annual Franchise Tax by Mail.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. The due date will be the next business day if may 15th 2022 falls on a weekend or holiday ie may 16th 2022. The maximum annual franchise tax is 2000000.

Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. Mailing instructions please mail your completed return officer information and payment to oklahoma. Mail your return to.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Instructions for completing the Form 512 512 corporation. The franchise tax is calculated at 25 cents per every 1000 of the corporations capital employed in or allocated into the businesss outpost within the state.

Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO.

The 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. When is franchise tax due.

TaxFormFinder - One Stop Every Tax Form. To make this election file Form 200-F. Oklahoma franchise tax due date 2021 thursday february 24.

Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. The franchise tax is waived for revenue and assets of less than 200000 and is capped at 20000. On the oklahoma tax commission website go to the business forms page.

The rules legislation and.

Corporation Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

Oklahoma Tax Commission Oktaxcommission Twitter

State Income Tax Extensions Weaver

State Income Tax Extensions Weaver

200 Oklahoma Annual Franchise Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Oklahoma Tax Commission Form Frx200 Fill Out Sign Online Dochub

Prepare And File Your Texas Franchise Tax Forms By Swahilifinance Fiverr

Form 511nr Oklahoma Nonresident Part Year Income Tax Return Youtube

Ok After Ef Acceptance Taxpayer Receives Rejection Letter

Oklahoma Tax Deadline Extended Two Months

Oklahoma Business Registration Oklahoma Llc Incfast

Application For Extension Of Time To File An Oklahoma Income Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Forms 512 Ft 512 Ft Sup Corporation Income And Franchise Forms 512 Ft 512 Ft Sup Corporation Income And Franchise Pdf Pdf4pro

Oklahoma Corporate Income Tax Forms And Instructions

Notice To Franchise Tax Board Pr021 Pdf Fpdf Doc Docx California